Proud Members of the Self Storage Association

We are very pleased to announce that we have become supplier members of the Self Storage Association UK.

The SSA is the principal trade association representing both self storage operators and industry supplier members’ interests in the UK.

Supplier members of the SSA are believed to be the best in business, ensuring members and the industry are well serviced to help them grow and protect their businesses.

Beavis Morgan has been working with companies in the self storage sector for many years, offering specialised Research & Development Tax Relief and other business advisory services.

Technical innovation, creativity and problem solving are skills inherent in the day to day running of a self storage business. It’s the close correlation of these skillsets with the prerequisites for a successful R&D claim that have led many self storage companies to take note of the opportunities for a substantial tax rebate from HMRC.

Particular activities which may indicate eligibility would include:

- Bespoke software and web development

- Innovative design and use of space

- Implementing new technology systems eg. sensors, door systems to improve security

- Automation to improve efficiency

- Data analytics

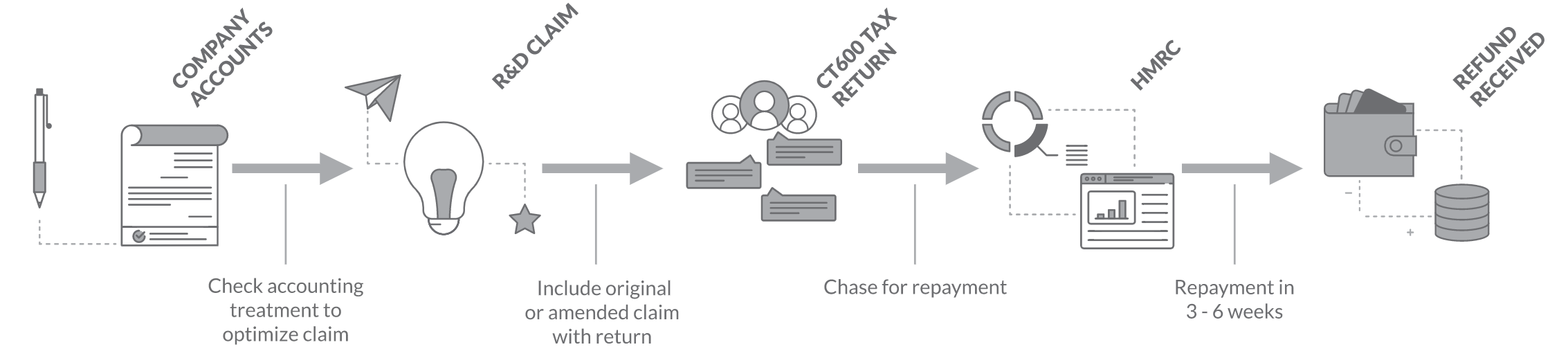

We have worked closely with several clients in the self storage sector, securing valuable R&D tax benefits in 5 easy steps:

Being part of a full service firm of accountants, tax and business advisers, we are well placed to deal with the complex tax benefits that can be derived from a claim, and complete the tax computation returns, HMRC submissions and chasing the Revenue for repayment timeously and without delay.

View our R&D tax calculator

Unlike most calculators, our Beavis Morgan R&D calculator is unusually very accurate. All you need to do is input just three key figures.

The calculation for R&D Tax Relief is actually quite complicated and it relies on the interaction between there 3 key numbers – eligible expenditure, tax adjusted profit or loss, and any brought forward tax losses.

Armed with this information, our calculator will give a true value of the tax benefit we can secure for you, whereas other more basic calculations will usually put the tax benefit as an average of 20 – 33% of R&D expenditure.

Give it a try, get in touch and find out for yourself.

For more information about how we can claim tax relief of up to 33% on your qualifying research and developments costs, contact Steve Govey or Rebecca Heap:

T.+ 44 (0) 20 7417 0417

Visit us at: 82 St John Street, London, EC1M 4JN