April 2023 changes to R&D Scheme – How will this impact your business?

In our recent webinar, we looked at the changes to the R&D Tax Relief scheme which came into force in April 2023 and discussed how businesses can prepare for these changes. We also highlighted the potential benefits and drawbacks of the new scheme and provided practical tips on how to maximise your R&D Tax Relief claim under the new rules.

Here is a summary for those who participated in our webinar, as well as an update for those who were unable to attend but requested more details.

The R&D Scheme changes – An overview

Chancellor Jeremy Hunt announced alterations to the Research and Development (R&D) Tax Relief for British businesses in the 2022 Autumn Statement. These changes, which took effect in April 2023, apply to both SMEs (small and medium-sized companies) and large businesses. The adjustments to R&D Tax Relief align with the Treasury’s strategy for investment in UK innovation. Under the new scheme, the R&D SME program will receive a reduced tax relief rate, while the R&D Expenditure Credit (RDEC) will receive an increased rate. In the 2023 Spring Budget, these changes were confirmed along with the introduction of a new category for R&D-intensive businesses. This category will provide an elevated rate for loss-making R&D SMEs whose R&D expenses exceed 40% of their annual expenditure. The changes will benefit the most creative companies and demonstrate the government’s commitment to combatting abuse and enhancing regulatory compliance.

What adjustments will be made to the R&D relief rates?

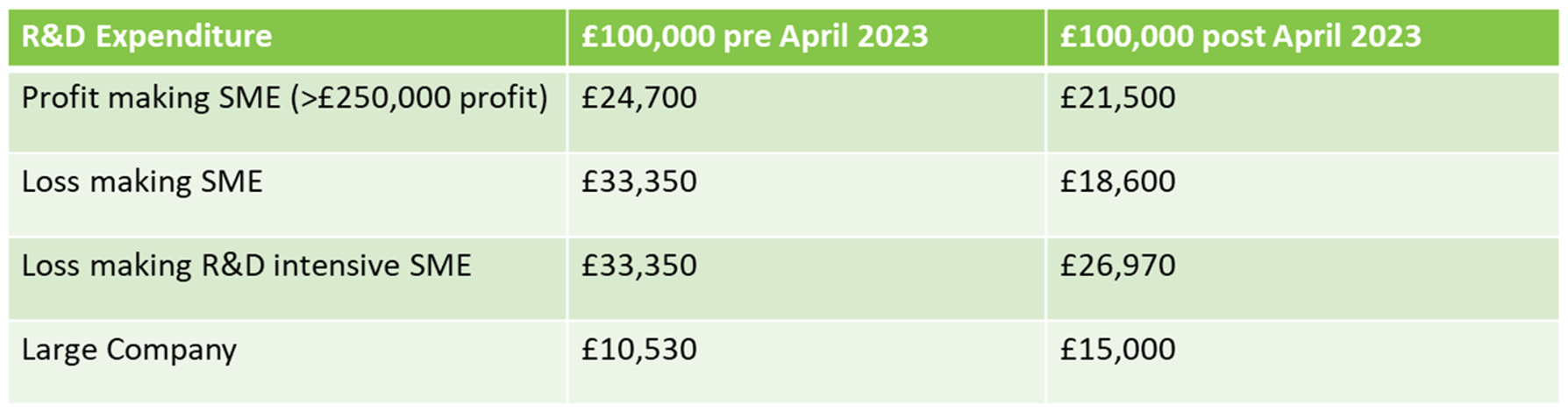

Starting from 1 April 2023, the additional deduction for SMEs will decrease from 130% to 86% for expenditures made on or after that date, and the SME credit rate will decrease from 14.5% to 10%. However, the SME credit rate will remain at 14.5% for R&D intensive businesses. Meanwhile, the Research and Development Expenditure Credit (RDEC) rate will increase from 13% to 20% for expenditures incurred on or after 1 April 2023. The following table summarises the impact of these changes on R&D benefits:

Why are the R&D relief rates changing?

The UK government is changing the rates for R&D relief in order to ensure that public money is spent effectively and that innovation is best supported. The aim is to reduce waste and increase investment in R&D, which in turn will help to boost economic growth through private investment.

Changes to the SME R&D scheme have been prompted by instances of tax relief fraud. According to HMRC’s 2021-2022 Annual Report and Accounts, the SME scheme had a 7.3% error and fraud rate, compared to 1.1% for the RDEC scheme, resulting in a total of £469 million lost (£430 million from the SME R&D scheme and £39 million from RDEC).*

The Treasury believes that the RDEC scheme encourages groundbreaking innovation, helps to build crucial assets in UK businesses, and delivers value to taxpayers. In order to enhance RDEC’s competitiveness on the international stage, the relief rates have been increased.

Is the SME R&D programme still beneficial?

Absolutely! The UK government is still committed to supporting SMEs that conduct extensive research, and the available tax relief can be a great help. It is important to consider the 2023 changes as a whole, despite the less generous relief. For example, starting from April 2023, companies with profits over £250,000 will face a 25% Corporation Tax, which will only reduce R&D Tax Credits by £3.20 per £100 spent. Even for SMEs that are unprofitable or less profitable, the financial boost provided by R&D Tax Credits can make a significant difference, especially with rising costs. Some innovative companies will also fall into the R&D intensive company category, which would enable them to benefit from a higher tax credit rate under the revised SME scheme.

What else changed in April 2023 with respect to R&D Tax Relief?

In April 2023, several changes to R&D Tax Relief were implemented to prevent fraud and improve the effectiveness of the scheme.

One significant change was that all claims must be submitted digitally, which allows HMRC to assess risks better and review R&D expenses.

Additionally, claims must be supported by more detailed expenditure breakdowns and must be backed up by a named company officer. An additional form with this detail will be required for all claims from 1st August 2023.

Any agents involved in the submission must be identified in each R&D claim to prevent fraudulent claims, and first-time claimants or companies that have not filed a claim in the previous three accounting periods must submit a pre-notification of their claim for accounting periods commencing on or after 1st April 2023.

The categories of qualifying expenditure have been expanded to include cloud computing and data costs, and costs related to pure mathematics projects.

However, from April 2024, some costs for overseas subcontracting and Externally Provided Workers (EPWs) not paid through a UK payroll will be excluded from qualifying expenses.

How can I ensure the validity of my R&D tax relief claim?

To ensure compliance with the new rules for R&D Tax Credits, it is crucial for businesses to work with reputable providers who can guide them through the process. With the increased emphasis on compliance and the need for a named senior officer to support all claims, navigating the new regulations can be more challenging for businesses. Engaging a trustworthy provider can help prevent potential issues and HMRC enquiries related to your R&D claim.

What effect will the changes have on my upcoming R&D Tax Relief claim?

Your R&D Tax Relief claim for the current accounting period will not be affected by the upcoming changes in rates, as they will only apply to expenses incurred from 1 April 2023. However, it’s crucial to ensure that your business doesn’t miss out on any eligible tax relief. Additionally, the new rules requiring digital submission, additional evidence, and named company officers to support claims may affect the process and timing of your claim, so it’s advisable to seek guidance from a reputable provider to ensure compliance with the new regulations.

What projects qualify for R&D Tax Relief?

To qualify for R&D Tax Relief, a project must meet certain criteria. The project must seek to achieve an advance in science or technology through the resolution of scientific or technological uncertainty. This means that the project must aim to develop new or improved products, processes, services, or materials, or advance the state of knowledge in a field of science or technology. The project must also involve the resolution of scientific or technological uncertainties, which means that there must be an element of experimentation or trial and error involved.

In addition, the project must be undertaken by a UK company that is subject to UK Corporation Tax. The project can be carried out by the company itself or by a subcontractor, but the company must have the contractual and financial responsibility for the R&D.

A reputable R&D Tax Relief provider will help to determine whether your project qualifies for relief, and guide you through the changes in legislation to ensure that your claim is still valid and maximised, and ensure that you are not missing out on any potential benefits.

Specialist R&D Tax guidance and assistance

It is important for businesses to understand the changes and ensure compliance to reduce the likelihood of any HMRC enquiries, or to effectively manage an enquiry should it arise.

Our team at Beavis Morgan, comprised of both tax and engineering experts, has extensive experience supporting businesses across the UK that develop innovative products and services. We can help you redefine your approach to claiming R&D relief, both strategically and practically, and provide expert support to ensure confidence in your future claims and funding.

If you require assistance or guidance, please contact our specialist R&D adviser, Rebecca Heap, in our Beavis Morgan R&D Tax Relief team. You can contact Rebecca via mobile at +44 (0)7551 578569, direct line at +44 (0)207 549 2357, or email at Rebecca.Heap@Beavismorgan.com.

Disclaimer: It is recommended that you seek professional advice before acting or refraining from action on any of the content herein. Information accurate at time of publishing, May 2023.